After the news broke about the Rochester City School District’s $30 million budget deficit, a whirlwind of effects came about. Teachers and staff learned about possible mid-year layoffs, parents and students were outraged and the city’s bond rating was lowered.

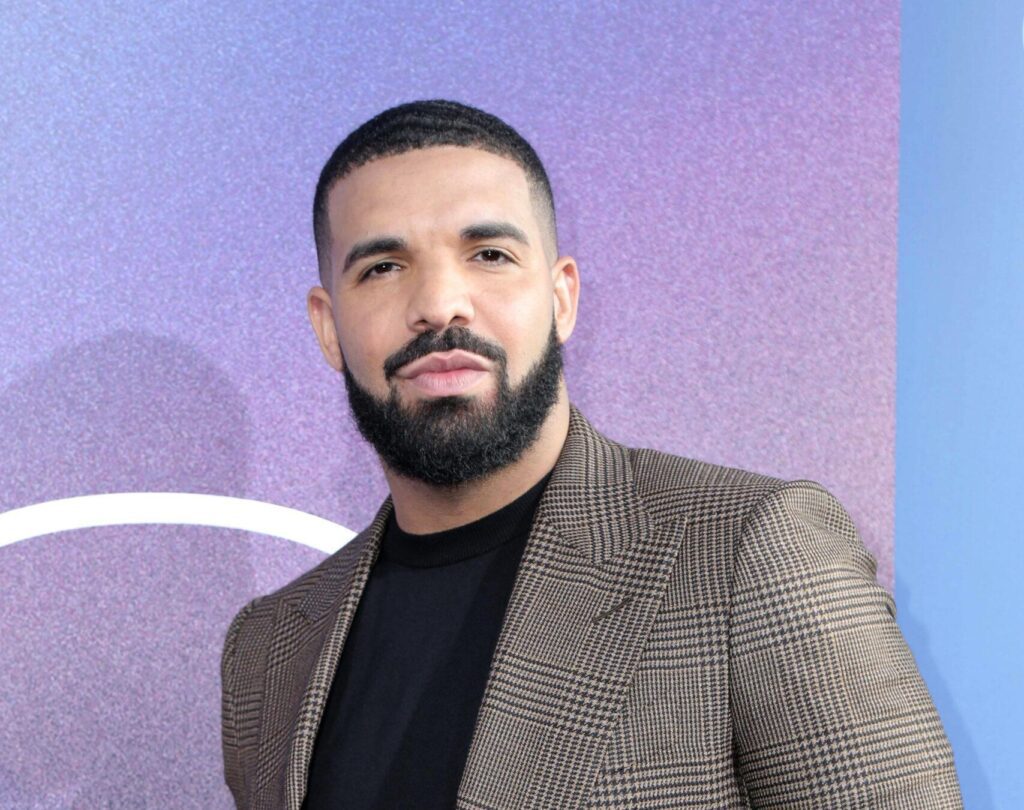

Now we’re finding out that there’s still more to come. According to city of Rochester Mayor Lovely A. Warren, this credit lowering will negatively impact tax payers. Due to the RCSD being a dependent district, meaning it’s finances are linked with the city, the overspending caused Moody’s Investors Service to lower Rochester’s bond rating from Aa3 to A2.

Mayor Warren says, “The mismanagement of the school district funds has really impacted all of the taxpayers in the city of Rochester, and we have to make sure that the district is managed correctly.”

“The Moody’s report clearly outlines the fact that the city of Rochester itself is managed very well we have been very, very conservative,” Warren said. “We manage our money the way that we’re supposed to, (and) pay the bills that we’re supposed to pay.”

In the words of Brighton Securities Chairman George Conboy, “It’s a little bit like if you pay all your bills on time, but you cosign a loan for your brother, and your brother doesn’t pay, that’s going to affect your credit rating, and that’s what you have, in this case,” he said. “If the city has a lower credit rating, when they borrow money, they’ll pay higher interest rates. When the city pays higher interest rates that translates directly into higher property taxes.”

Mayor Warren went on to remind residents that digging the city out of $30 million budget deficit isn’t something that can be done overnight.

“It’s going to take very tough decisions in order to realize the long term impacts of a $30 million overspent,” she said.

To read the detailed Moody’s report, click here.